The Research Tax Credit (RTC) and the Young PhD Schemehttps://www.service-public.fr/professionnels-entreprises/vosdroits/F23533

The Research Tax Credit (CIR)

What is the CIR?

- A tax incentive for Research and Development

Which companies are eligible?

- Companies that have financial expenses for fundamental or applied research and experimental development.

- There are no sector or size restrictions

Which tax credit?

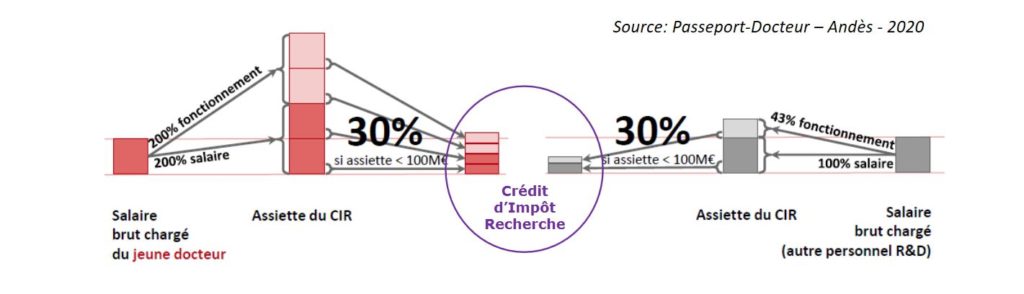

- Eligible expenses = 100% of R&D personnel expenses + 43% of operating expenses related to these jobs

- The rate varies according to the expenses incurred

➢ If annual expenditure <100 M€, CIR= 30% of eligible expenditure

➢ If expenditure >100 M€, CIR = 5% of eligible expenditure

More info

➢ https://www.service-public.fr/professionnels-entreprises/vosdroits/F23533

➢ Guide to the CIR 2020

The Young PhD scheme : an asset for PhDs to promote to companies

What is the Young PhD scheme?

It is a special case of the CIR which doubles the tax advantage for the company.

Its objective?

To encourage the employment of PhDs on permanent contracts by companies

How does it work?

Eligible staff expenses relating to PhDs hired for the first time on permanent contracts (salary + operating costs relating to these jobs) are taken into account for double their amount during the first 24 months.